Sequoia Capital: Adapting To Endure

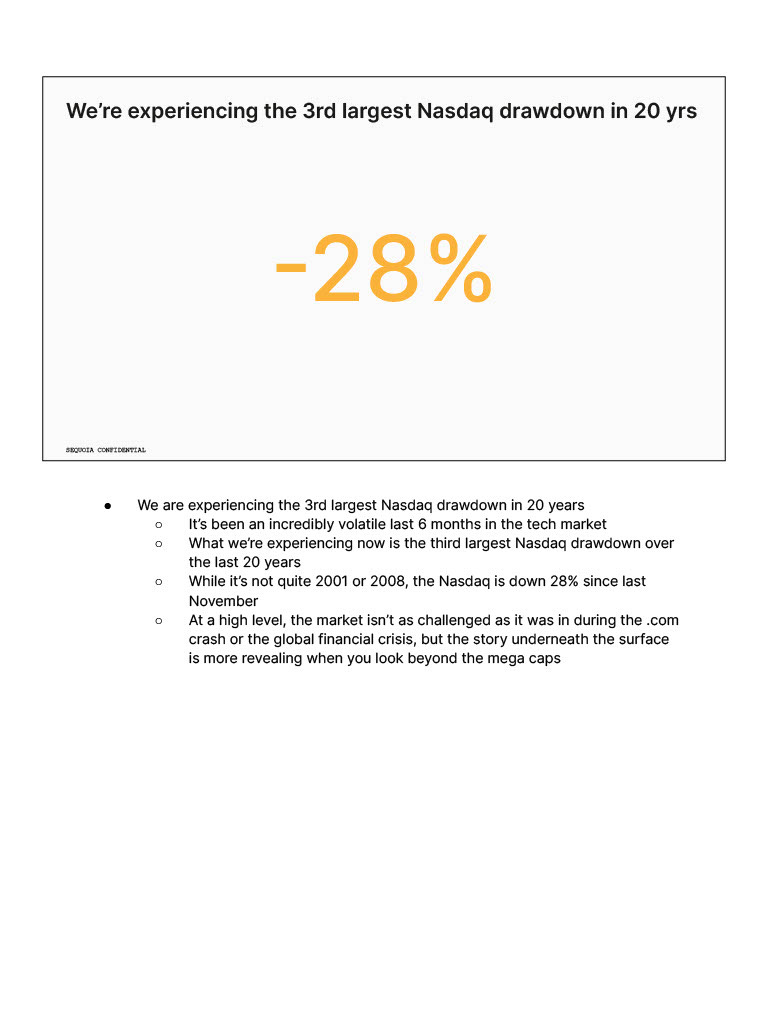

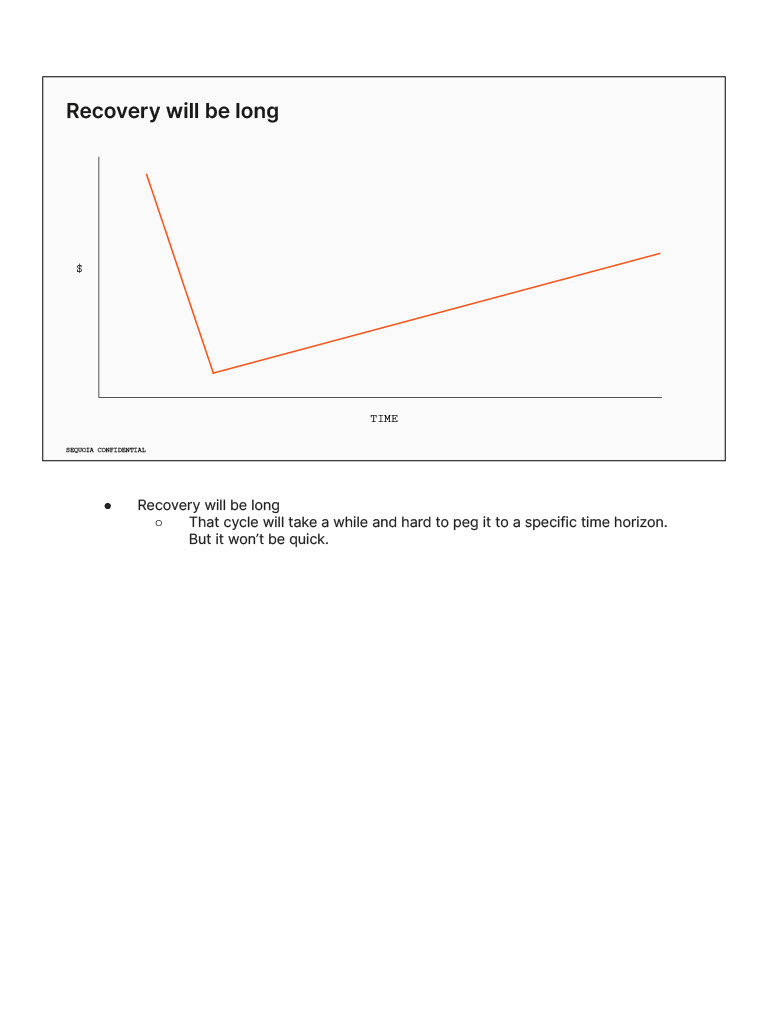

There will be no V-shaped recovery as we saw coming out of COVID in 2020. This time, recover will be long according to Sequoia Capital

Sequoia Capital, a legendary venture capital firm, invested in Apple, Google, Oracle, LinkedIn, PayPal, and many more before they went public.

The firm presented a 52-page presentation to their portfolio founders in May 2022 to help founders survive and win from this crisis.

A couple of key takeaways:

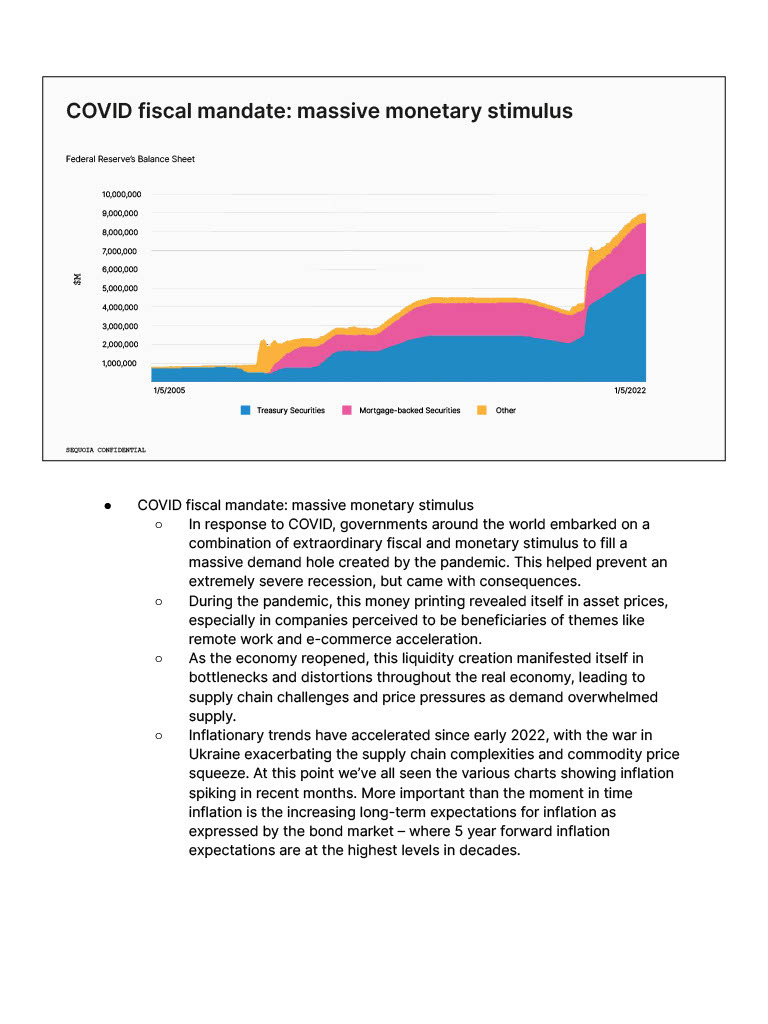

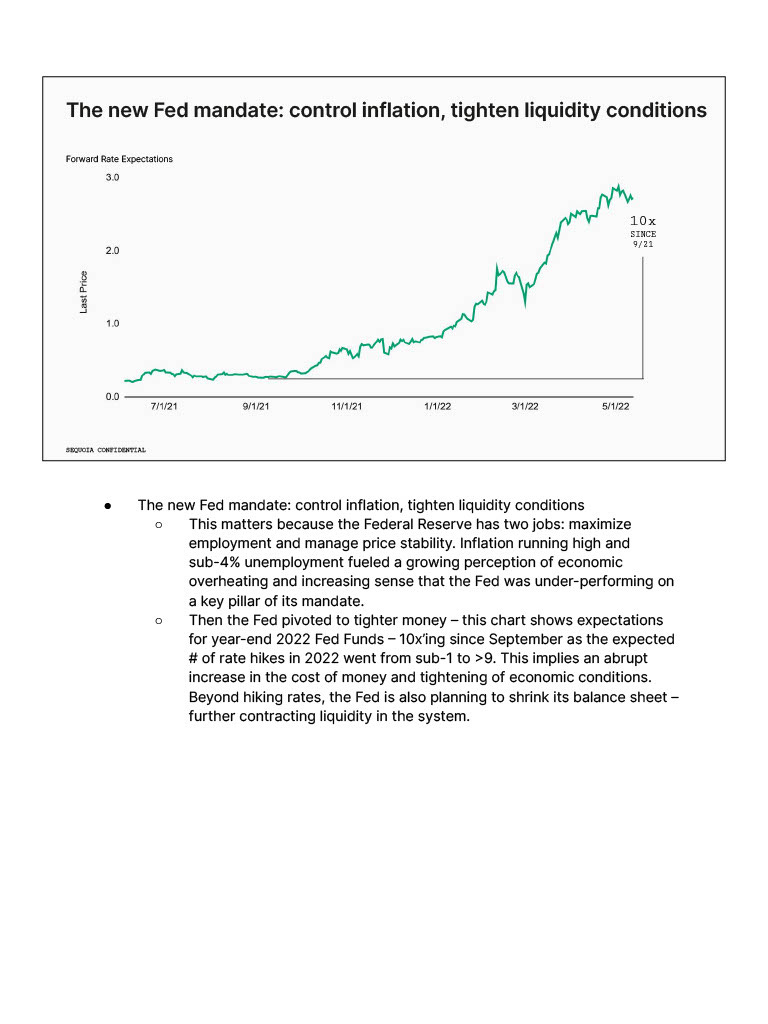

There will be no V-shaped recovery as we saw coming out of COVID in 2020. This time, recover will be long.

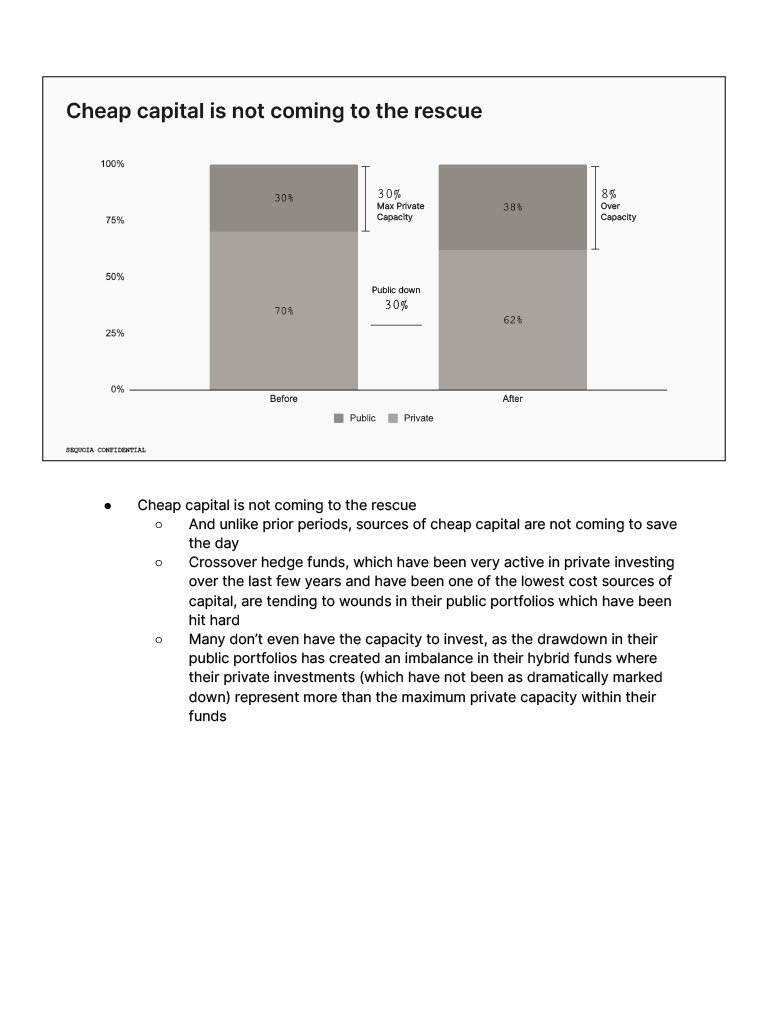

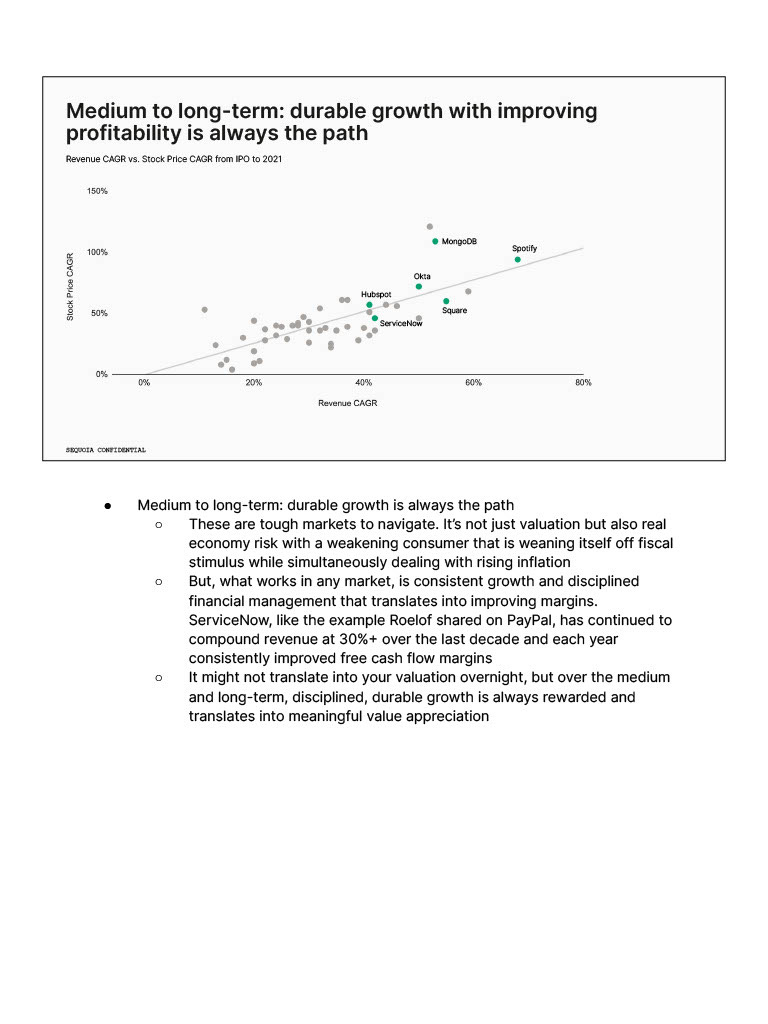

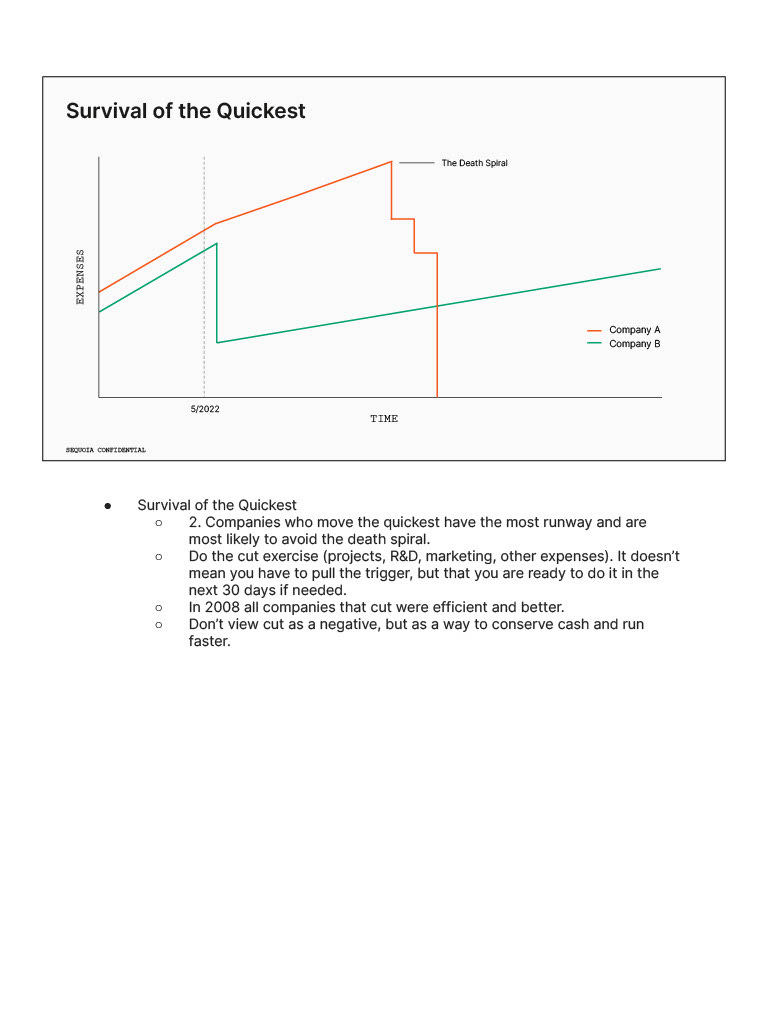

Capital was free, now it's expensive. To win from this recession, founders need to adapt quickly, change priorities, preserve cash, reduce costs, and focus on durable growth with improving profitability. “Pain of discipline < pain of regret”.

Prepare yourself

Confront the reality.

View this crisis as an opportunity. “Opportunities arise in bad weather. “You cannot overtake 15 cars when it is sunny but you can when it’s raining. Look at this as a time of incredible opportunity.”

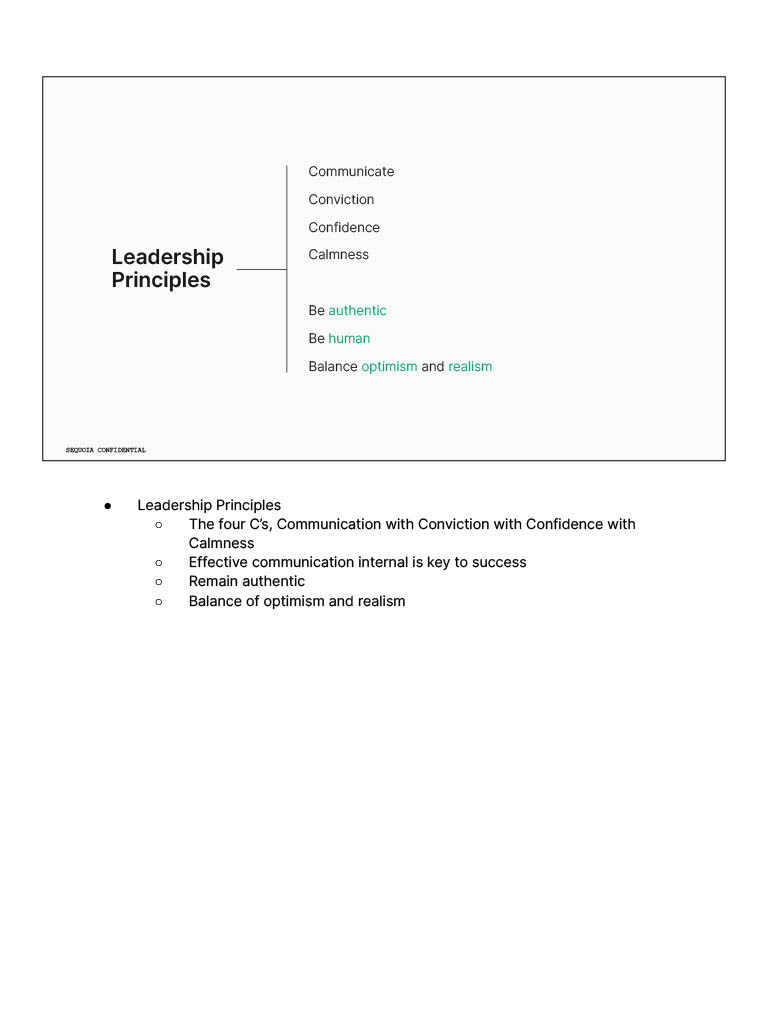

Prepare your team

Reaffirm your mission and fundamental values.

Showcase your leadership and get your team aligned with the company’s mission.

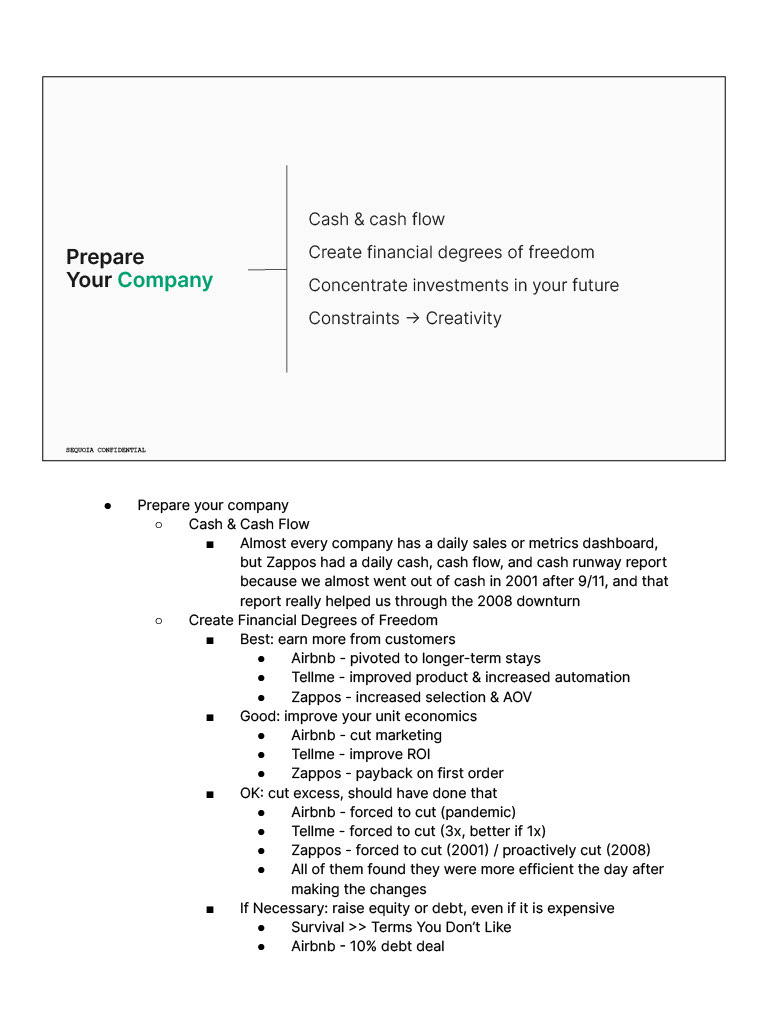

Prepare your company

Set up a dashboard of your company’s daily cash, cash flow and cash runway.

Cut excess and improve your unit economics

Adapt quickly and move fast. “It is not the strongest of the species that survive, nor the most intelligent, but the one most responsive to change.”

Below is the entire presentation deck. Enjoy :)!